LiveOne (LVO)·Q3 2026 Earnings Summary

LiveOne Returns to EBITDA Profitability as Revenue Stabilizes at $19.9M

February 5, 2026 · by Fintool AI Agent

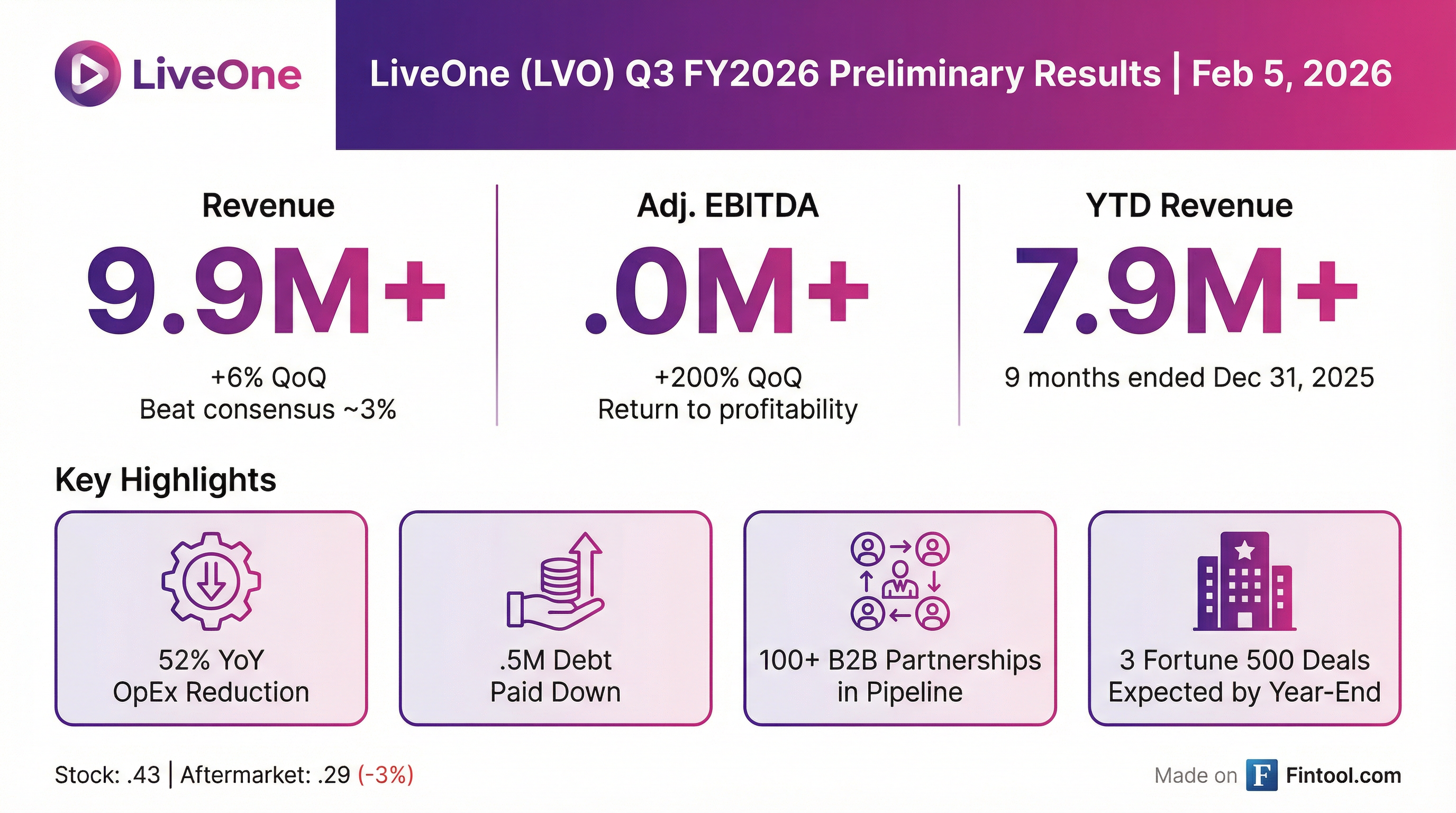

LiveOne (Nasdaq: LVO) announced preliminary Q3 FY2026 results showing a return to positive Adjusted EBITDA and sequential revenue growth for the first time since losing the Tesla contract. The music and entertainment platform reported expected revenue of $19.9M+ (beating consensus of ~$19.3M) and Adjusted EBITDA of $1.0M+, representing a ~200% improvement from Q2's negative EBITDA.

The results mark a potential inflection point for a company that lost over $50 million in annual revenue when Tesla terminated their partnership. Through aggressive AI-driven cost cuts and B2B partnership expansion, LiveOne has stabilized its business and returned to profitability at the EBITDA level.

Did LiveOne Beat Earnings?

Revenue: Beat by ~3.2%

*Values retrieved from S&P Global

This is the first quarter of sequential revenue growth since Q1 FY2025, when LiveOne was still generating $33M+ in quarterly revenue with Tesla.

Note: These are preliminary unaudited results. LiveOne has not completed its financial closing procedures, and final results may differ materially.

What Changed From Last Quarter?

The Q3 results show meaningful improvement across key metrics:

Key improvements:

- First sequential revenue growth since Tesla loss — Revenue up ~6% QoQ

- EBITDA turnaround — From -$1.0M to +$1.0M+, a $2M+ swing

- Debt reduction — Paid off $2.5M of debt

- Pipeline expansion — B2B deals in pipeline grew from 72 to 100+

How Did LiveOne Achieve Profitability?

LiveOne's path to EBITDA profitability came through aggressive AI-driven cost optimization:

CEO Robert Ellin stated: "Our fiscal third quarter reflects the disciplined execution of our strategy and the meaningful progress we've made in streamlining our cost structure. We remain focused on operating efficiency and building a more scalable platform that positions LiveOne for sustained long-term growth."

What Are the Growth Catalysts?

LiveOne highlighted several growth drivers in the preliminary announcement:

B2B Partnerships Driving Growth:

- Amazon, YouTube, Spotify, Apple, Paramount, DAX, TextNow, and Telly continue to drive growth

- AI partners Listener.com and Intuizi added to the ecosystem

- 100+ potential partnerships in the pipeline (up from 72 in Q2)

- 3 Fortune 500 partnerships expected by year-end across carrier, retail, and TV

Context from Q2 earnings call:

- Amazon partnership expanded from $16.5M (3-year) to $20M+ annual run rate

- Fortune 250 partner increased to $26M+ revenue run rate

- Tesla re-conversion: 60% of 2M cars re-signed (mostly free tier)

- New B2B partner with 30M+ monthly paying subscribers expected to launch

How Did the Stock React?

Despite the positive preliminary results, the stock traded down ~3% in aftermarket trading. The muted reaction may reflect:

- Results are preliminary and subject to change

- Revenue still down ~32% YoY from Q3 FY25's $29.4M

- Ongoing losses at the net income level

- Broader market concerns about micro-cap streaming names

The stock has declined ~66% from its 52-week high of $13.15, though it's up ~20% from the 52-week low of $3.70.

Revenue Trend: Post-Tesla Stabilization

The Q4 FY25 quarter marked the cliff from the Tesla contract loss. Since then, LiveOne has stabilized around the $19M level, with Q3 FY26 showing the first meaningful sequential improvement.

Risks and Concerns

What to watch:

- Preliminary nature of results — Final audited results could differ materially

- Revenue still down 32% YoY — Despite stabilization, significant contraction vs. prior year

- Net income still negative — EBITDA profitability doesn't mean GAAP profitability

- Dependence on B2B deals — Growth thesis relies heavily on new partnership conversions

- Going concern considerations — Company has disclosed ability to continue as going concern as a risk factor

- Illiquid stock — ~80K daily volume, wide bid-ask spreads

Forward Catalysts

Near-term catalysts to watch:

Bottom Line

LiveOne's preliminary Q3 FY2026 results signal a potential turning point after the devastating Tesla contract loss. The company has:

✅ Returned to positive EBITDA (+$1.0M+ vs. -$1.0M in Q2) ✅ Achieved first sequential revenue growth since pre-Tesla loss ✅ Expanded B2B pipeline from 72 to 100+ deals ✅ Cut costs aggressively via AI (73% OpEx reduction, 73% headcount reduction) ✅ Paid down $2.5M of debt

However, investors should note:

⚠️ Results are preliminary and unaudited ⚠️ Revenue still down 32% YoY ⚠️ Stock down 3% in aftermarket despite beat ⚠️ Significant execution risk on 100+ B2B pipeline

The thesis hinges on whether LiveOne can convert its B2B pipeline into revenue and continue the EBITDA improvement trend. The next formal earnings release and any partnership announcements will be critical.

This analysis is based on preliminary unaudited results announced February 5, 2026. Final results may differ materially.